https://econsultancy.com/stats-roundup-coronavirus-impact-on-marketing-ecommerce-advertising/

Of course, this has wide-ranging ramifications for marketing, advertising and ecommerce – as well as a number of other sectors like travel, entertainment and FMCG.

To help marketers keep on top of what this means for them, their jobs and their industry, we’re collecting together the most valuable and impactful stats in this roundup, updated on a weekly basis since 20th March.

Read on for statistics on retail sales, adspend, streaming subscriptions, social media use, recruitment figures and much, much more.

And to learn more about how the industry is being impacted, join our regular broadcast with marketing thought-leaders, The Lowdown.

Contents

Retail & FMCG

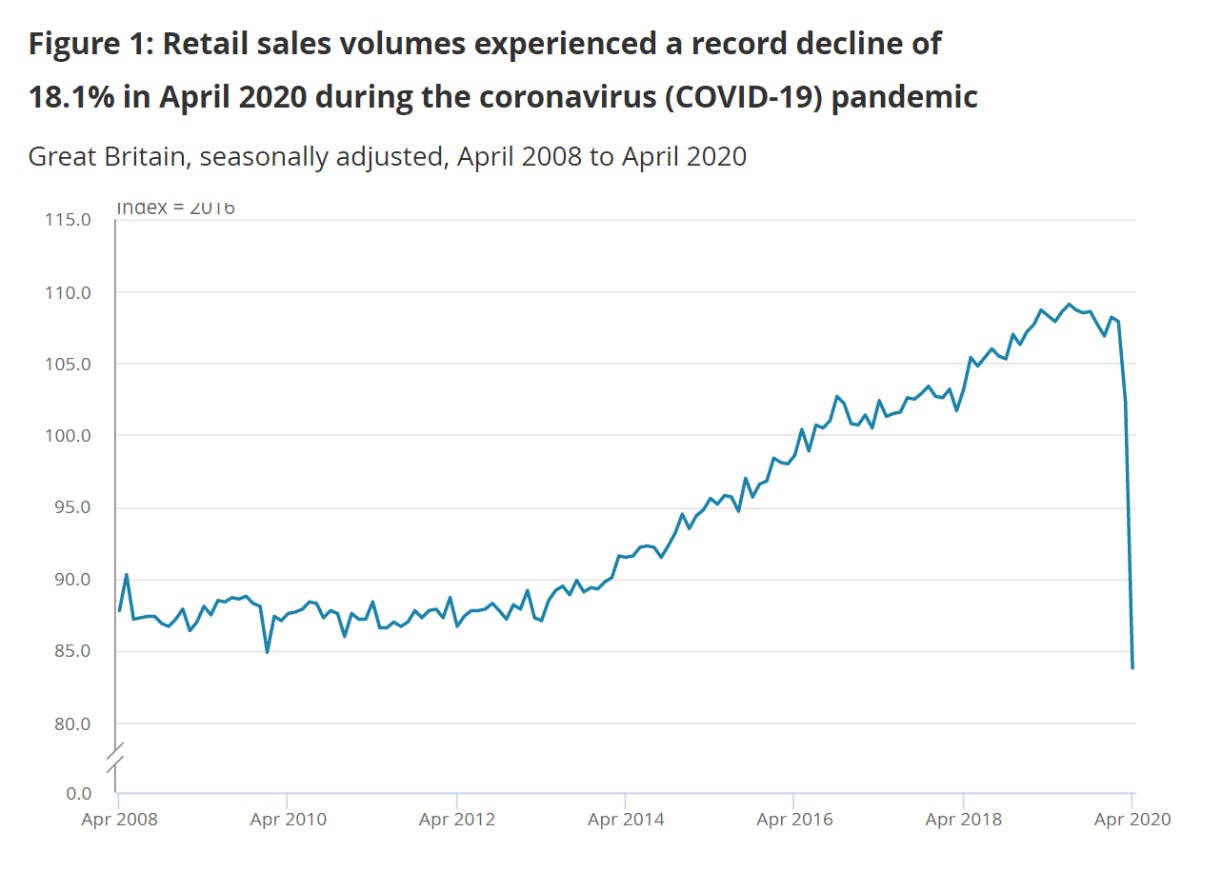

British retail sales drop by a record 18.1% during April

Following a 5.2% drop throughout March, total British retail sales fell by 18.1% in April (month-on-month), marking the greatest decline since records began in 1988, according to the Office for National Statistics. Adjusted to year-on-year, the picture is even bleaker at a -23.1% drop compared to April 2019.

Chart via the Office for National Statistics

Of all stores, 14.3% described having zero turnover during April. Department stores and textile, clothing and footwear stores were unsurprisingly hit most severely, with 39.1% and 27.6% respectively reporting no income during the same period. As a result, both saw rapid contractions in month-on-month growth of -25.3% and -50.2%.

Meanwhile, food stores (including supermarket food stores, specialist food stores and alcohol and tobacco) saw a 4.1% drop in sales growth month-on-month, following strong performance in March, which was 10.1% up over February.

As lockdown continues to affect brick-and-mortar stores, online shopping as a proportion of all retail reached 30.7% in April, up from 22.4% in March.

Retail sector expected to see $2.1tn global loss in 2020

Forrester has predicted that the global loss in the retail sector will likely hit $2.1 trillion in 2020 and will take four years to overtake the levels of growth seen before the pandemic.

Although the impact will likely vary across different regions, it is thought that non-grocery offline sales will see a 20% decline in growth overall, while ecommerce growth will remain mostly neutral.

In the US, sales are expected to drop by $321 billion this year, down 9.1% from 2019, and there’s a similar picture for Canadian retail spending, which is predicted to fall 7.7% (a loss of $25 billion).

Meanwhile, a total €260 billion fall (-10.4% on 2019) is anticipated across the EU-5 – UK, France, Spain, Germany and Italy – with some of these countries faring better than others. France, for example, could experience a loss of €56 billion, a decline of 9.5% year-on-year, while the UK may see up to a 11.4% decline compared to the same period (a comparable loss of -£56 billion).

China is forecast to be worst affected in APAC’s retail predictions, which could lose $192 billion out of a total $767 billion for the region.

In contrast, Latin America could see the smallest percentage loss out of all territories analysed at 6.8%.

How is coronavirus impacting the retail industry?

Luxury brands forecast sales drop of $85-$120 billion in 2020

Luxury brands are now forecast to lose between $85-$120 billion in sales in 2020, accounting for 29.2% of the luxury market, according to Boston Consulting Group (BCG). Meanwhile, the fashion and luxury sector as a whole could lose up to $600 billion this year.

Original forecasts by the group in February suggested a 15% global drop in EBITDA for luxury retail, adding up to a £30-40 billion decline in sales in total for 2020. This has since been revised to reflect a more negative outlook as the coronavirus continues its severe global impact.

Europe’s luxury market is expected to be hit the hardest by the outbreak, with an average sales loss of more than 35% expected over the course of 2020, while the Americas could experience between a 25-35% decline. A fairly recent boom in China’s luxury market could mean that it becomes the least affected region at a less than 25% decline overall.

The BCG now estimates that global sales for the industry will reach their lowest point during the second quarter – in some regions at rates as low as -80% year-on-year – before recovering somewhat throughout the second half of 2020. By December, sales could bounce back to around 10-15% below 2019 levels for that month.

North American chain stores see an 80% year-on-year rise in ecommerce sales

Traditional chain stores in the US and Canada have seen an 80% year-on-year rise in online sales in April 2020, a figure significantly higher than that of digitally native retailers (53%) and traditional department stores (up 44%).

According to Bluecore’s Covid-19 Retail Trends report, the number of first-time purchases placed through the ecommerce sites belonging to traditional chain stores grew by a whopping 119% compared to April last year. Meanwhile, department stores experienced a decline of 24% in this area, which suggests most first-time purchases take place instore rather than online in this instance.

In fact, year-on-year growth for chain stores has outpaced both other types of retailer in all categories of shopper interaction measured by Bluecore. This includes add-to-cart events (up 73%), product views (up 64%) and email sign ups (up 89%) and is reflective of the forced shift in consumer spending as retailers’ brick-and-mortar counterparts remain mostly closed.

Drilling down to sub-verticals, it seems as if pharmacy brands are benefitting particularly well from this new behaviour. Not only has the industry seen a 149% year-on-year increase in first-time online purchases, it has also recorded a 337% lift in email sign-ups vs. luxury (46%), beauty (41%), sports and outdoors (26%) and apparel (-3%).

Existing customers return to shopping apps (reattributions up 43% month-on-month in April)

Global reattributions of shopping apps (where a user has returned to an app due to a retargeting campaign) increased by 43% month-on-month in April, data from Adjust confirms.

As brands pulled back their spending on acquiring new users during March – the beginning of the coronavirus crisis for most of Europe and the US – there was a noticeable drop in shopping app installs and sessions.

However, since the beginning of April, there has been a considerable uplift in reattribution, indicating ad spend has resumed somewhat and that consumers may be gradually returning to their usual shopping habits. Statistics from the last week of April show reattribution at its highest level so far this year, proving that although new customers may be harder to come by, existing customers are being more successfully engaged by brands.

Chart via Adjust

Paid shopping app installs, while increasing on figures from March (up 21% month-on-month), still have a long way to go until they reach the levels seen in January and February and are dependent on future ad spending as to how quickly they will improve.

US consumers turn to name-brand products despite financial strain

Data from Survata shows that, despite 64% of US consumers claiming they are rethinking spending, many are choosing name-brands over generics when it comes to the products they are purchasing.

Unsurprisingly, this is particularly the case for cleaning products. In fact, 61% percent of respondents said that they were ‘likely’ or ‘very likely’ to choose brand-name varieties when shopping during the pandemic, compared to 39% who said they either ‘didn’t care’ or actively chose own-brand varieties.

Other product categories in which preference for branded products ranked highly were packaged foods at 58% (versus 42% who didn’t care or chose own-brand items), frozen food (57% vs 43%), and drinks like soda and coffee (54% vs 46%). In contrast, alcohol was the category which consumers cared least about whether it was branded or not.

When justifying their choices, sixty-four percent of shoppers cited ‘perceived availability’ of a product as an important factor, with 72% stating that they are now more aware of product availability than they were before the outbreak. A further 40% noted the trustworthiness of a brand as the biggest factor, ranking it about the same as the price of a product (39%) when it comes to influence on their purchase behaviour.

Average global sales revenue for online fashion stores in April was 21% higher year-on-year

Despite a severe 30% drop in global fashion ecommerce revenue in March, new findings from Nosto suggest that revenue in April has bounced back and is on average 21% higher than it was in April 2019. Australia/New Zealand, Germany and the UK have seen a particularly strong sales results, while other countries like Sweden continued to experience a rapid decline.

Visits to fashion ecommerce websites are up by an average 9% globally, while orders increased by 30% and conversion rate lifted by 12%.

Online fashion sales began dropping particularly noticeably from 7th March, reaching its lowest point on around 20th March, with year-on-year sales revenue (-32%) and visits (-24%) down very significantly across the globe. According Nosto’s data, sales and orders have rebounded sharply, overshadowing those in April 2019 despite a bleak global retail outlook caused by the pandemic.

However, average order value remains negative across the board at -3% compared to last year. Average order value in the UK is particularly low (-7%), but specific areas of Europe such as Germany and Sweden have been less impacted (-3% and -4% respectively).

UK auto sales fall by 97.3% year-on-year in April

Coronavirus has had a dramatic effect on the auto industry in the UK, with the The Society of Motor Manufacturers and Traders (SMMT) revealing that sales fell by 97.3% year-on-year during April.

Just 4321 new cars were registered last month, mostly in the fleet sector as delivery services continue to run. Meanwhile, a tiny 871 private vehicles were registered due to the majority of showrooms having been shut down since lockdown began. Total year-to-date sales were down by 43.4%.

Forecasts from the SMMT predict a further 1.68 million UK car sales for the remainder of the year, once restrictions are lifted, the lowest number of new vehicle registrations since 1992.

Chart via SMMT

Amazon year-on-year sales up by 26% in Q1 2020

Global sales on Amazon increased by 26% in Q1 2020, reaching $75.5bn compared to sales of $59.7bn in Q1 2019, data from its 30th April Q1 2020 results shows.

The brand exceeded its target revenue for the quarter, acquiring $75.5bn versus predictions of $73.7bn, but revenues for its web services fell slightly short of expectations ($10.22bn vs $10.29bn).

While more customers have clearly opted to shop with Amazon over the last few months, its overall revenue saw only a modest gain over its target due to higher operational costs that come from dealing with COVID-19. For example, so far, the company have hired an additional 175,000 new warehouse and distribution staff throughout March and April, as well as implementing pay rises of around $2 for its hourly workforce. Ensuring safety measures meet the correct standards during the pandemic, such as protection for employees and new operational processes, is an additional cost on top of the day-to-day running of the business.

In a statement, Amazon’s CEO Jeff Bezos said that the company expects to spend $4bn in Q2, which it would typically make in profit over that period, on continuing to keep workers safe during the outbreak.

Nearly half of global consumers say they will not return to shops for ‘some time’ or ‘a long time’ after lockdown ease

GlobalWebIndex’s ninth release of its coronavirus research has revealed that nearly half of global consumers do not expect to resume shopping in brick-and-mortar shops for ‘some time’ or ‘a long time’ once lockdowns ease.

Just 9% of shoppers, on average, expect that they will return to stores ‘immediately’ once they are allowed to. However, those in the UK, Ireland and Germany are more likely to do so (14%) than those in Japan (5%) or China (6%).

There is yet more reluctance towards outdoor public venues, such as stadiums and music festivals, with 60% of consumers anticipating that they will wait for ‘some time’ or ‘a long time’ before attending events there. The figure rises to two thirds for indoor spaces like cinemas and sports arenas, while only 4% hoped to return straight away to such venues.

The predicted behaviour of consumers, once restrictions are partially or fully lifted, raises concerns over how quickly brick-and-mortar stores, and the retail industry in general, will bounce back post-coronavirus. It seems that shoppers will continue to be concerned about the risks involved in interacting with wider society, and will therefore be hesitant to return to busy public places too soon.

96% of UK retailers have reported cashflow difficulties from March to April

Latest figures from the CBI show the extent of the impact the coronavirus crisis is having on the UK’s retail sector. Ninety-six percent of retailers in the region have reported cashflow difficulties since its most recent monthly Distributive Trades Survey was conducted between 27th March and 15th April.

Forty percent of those facing financial challenges said that they had had difficulties meeting tax liabilities, while 31% said they found external financial help hard to come by. As a result, 44% claimed that they had temporarily laid off staff (through the government furlough scheme or other methods) and a small percentage have resorted to permanent lay-offs (8%). Other major impacts on the sector, according to respondents of the survey, include delayed shipping (40%), shortages or products (39%) and ‘increased cost pressures’ (47%).

Consequently, it is expected that online stores will slash their prices in order to tempt consumers to part with their cash at this uncertain time. Online price growth grew negatively (-9%) in the year to April (for the first time since the question was added to the survey in 2009) and is predicted to fall again in the year to May 2020 (-7%). In contrast, online price growth for the year to March 2020 was +15%, revealing just how rapidly online stores are having to make strategic changes.

Advertising

89% of large multinational businesses have paused their advertising campaigns

Eighty nine percent of large multinational businesses have deferred their planned advertising campaigns due to the pandemic, up from 81% in March, says the World Federation of Advertisers (WFA). Results from the WFA’s Covid-19 Response Tracker have discovered that multinationals are much more likely to cut marketing spending more vigorously, and for a longer period of time, than smaller companies.

Delays in resuming campaigns and increasing ad spend for large multinational organisations are now expected to last a lot longer than originally anticipated. More than half of respondents that took part in the WFA’s phase two research said that they will rein in ad spend for the next six months compared to just 19% of respondents from phase one.

Sixty eight percent of those surveyed claimed that their companies have now put in place a ‘crisis response campaign’ in light of Covid-19, a figure which has more than doubled since March (32%). However, any income generated from such campaigns will not be able to make up for cuts to others, meaning global ad budgets are estimated to drop by 36% in H1 2020 (vs. 23% in the first phase of research).

Connected TV video ad impression volume grows 69% year-on-year

Global video ad impression volume for connected TV has grown by 69% year-on-year for the week 3rd-9th May, claims Innovid iQ, a platform which serves 1 in every 3 video ad impressions in the US. Despite year-on-year falloffs for video ad impressions on mobile (-12%) and desktop (-24%), significant uplift in the connected TV space has driven an overall video ad growth of 12% since the same time last year.

The automotive and retail sectors are experiencing more volatility than others, seeing a 7% drop week-over-week in impressions for the first full week of May, suggestive of the overall instability of those markets while many non-essential shops and showrooms have closed. Meanwhile, video ad impression volume for broadcast publishers, social and digital publishers saw gains of 33%, 6% and 5% respectively.

Across all verticals, global video volume by impressions increased by 12% year-on-year for the week commencing 3rd May, signifying a modest recovery after consistent year-on-year declines during four consecutive weeks prior.

Year-on-year change in global video ad impression volume by vertical (3rd-9th May). Chart via Innovid iQ

ITV ad revenue falls by 42%, 32 percentage points higher than it originally estimated

ITV have revealed that its ad revenue fell by 42% in April, after predicting, perhaps optimistically, that it would lose a little over 10% of its ad revenue during the period due to Covid-19. However, some analysts predicted losses of around 50%, a figure which now appears much more accurate in retrospect.

It seems that many more advertisers have pulled their campaigns from the broadcaster likely due to ongoing financial uncertainty, combined with lockdown measures affecting consumer spending. In turn, this has caused ITV to temporarily furlough over 800 staff members and slow or stop production of some of its best known shows like Love Island.

In February, the broadcaster’s ad revenue was up 8% year-on-year, before lowering in March resulting in a neutral growth rate compared to March 2019. April’s final figures, while alarming, were not as bad as some analysts had predicted, however it is still uncertain as to the ongoing impact into May and beyond.

UK adspend projected to fall 16.7% in 2020

After UK adspend increased by 6.9% year-on-year during 2019, in a ten-year consecutive growth trend, it is now projected to fall by 16.7% in 2020 to £21.13bn. This is according to The Advertising Association and WARC’s latest quarterly Expenditure Report.

Although adspend during the beginning of Q1 2020 was encouraging, the huge impact that the coronavirus crisis has had on the industry has caused forecasts to be revised downwards for the year ahead. Original estimates predicted that adspend would grow by 5.2% this year to more than £26bn, but now experts believe that growth will decline in 2020 before rising again in 2021 at around 13.6%.

Focusing in, search and online display adspend is thought to fall by a little over 12% and TV by 19.8%, while publishers are expecting to see an even sharper dip in adspend (20-24% for national and regional newsbrands) following a continuous downward trend in this area.

Imagery of human interaction declines 27.4% in social ads

A new study by Pattern89, published on 24th March, has noted a shift in the type of imagery brands are using in social media ads since the start of the coronavirus pandemic. Analysing more than 1,100 brands and advertisers active on Facebook and Instagram, Pattern89 found that there are 27.4% fewer images and videos ads of models displaying human interaction (such as hugging or shaking hands).

Since 12th March, imagery featuring people washing hands or faces, and images and videos that display water splashing or cleaning have risen at six times the normal rate. Meanwhile, headline and body copy mentioning “Sports & Fitness” topics has quadrupled (rising from 5.7% to 21% of all ads) since March 12th. Similarly, electronics (such as smartphones or TVs) are now appearing in 39% of social ads.

How brands are encouraging social distancing

How brands are encouraging social distancing

60% of Covid-19 related content is brand safe

Up to 60% of online COVID-19 related content is brand safe, according to GumGum’s machine learning based analysis. This is despite many brands actively blocking keywords linked with the virus, such as ‘COVID-19’, ‘coronavirus’, ‘pandemic’ and ‘quarantine’, in order to avoid negative associations.

The data estimates that, of all content that was analysed, around 2 million unique coronavirus related pages had been created over the thirteen-day period between 25th March-6th April, with an average of 100k safe pages being added every day.

Content categories with the highest number of safe pages were ‘business and finance’ at around 150,000 unique pages over the course of the same period, while ‘medical health’ and ‘news and politics’ ranked second and third respectively. However, these also had the largest percentage of unsafe pages due to the sheer volume of content produced by publishers in these sectors compared to others.

As a result, in just one week alone, analysed brands that depend on keyword-based tools are missing out on around 1.5 billion impressions on their ads. This comes during a time where increasing numbers of people are consuming online content, not to mention for longer periods of time, and COVID-19 has remained the top trending topic over the course of the last several months.

Mobile reaches 51% share of total display ad impressions

Mobile has reached a 51% share of total display ad impressions, up three percentage points since before the beginning of the pandemic, according to PubMatic.

The coronavirus has hastened the rate at which spending on advertising is shifting from desktop platforms to mobile platforms, the report reveals. Total mobile ad spend has fallen by 15% since the start of the outbreak (early March) compared to desktop ad spending, which dropped by 25% during the same period.

Video ad spend on mobile declined significantly (27%), while display experienced a lesser impact (12%). Despite this, global video ad spend share for mobile lingered at 49% during Q1 2020, however, this is expected to decline during Q2 2020. There were notable regional variations – EMEA and APAC mobile saw a 67% share in video ad spend within their respective markets in the first quarter, while in the Americas it saw a smaller 44% share.

Social media

Facebook Daily Active Users increase by 11% year-on-year

Facebook’s Q1 2020 results have shown an increase in its Daily Active Users (DAUs) of 11% year-on-year (1.7 billion), driven by an uplift in social media engagement from stay-at-home orders in place. Its Monthly Active Users (MAUs) saw a similar growth of 10% (2.6 bilion).

However, despite heightened usage, Facebook’s ad revenue for the quarter rose by 17% year-on-year, nine percentage points lower than the 26% growth it saw in Q1 2019 vs Q1 2018. Facebook admitted that it had ‘experienced a significant reduction in the demand for advertising, as well as a related decline in the pricing of ads, over the last three weeks of the first quarter of 2020’, indicating that its revenue growth could dip even lower if ad spend remains sluggish between April and June.

In a recent blog post, Facebook stated that voice and video calling across Messenger and WhatsApp has more than doubled in areas hardest hit by the coronavirus, and that total messaging across all of its owned apps has increased more than 50%.

Instagram influencers lose on average 33% of their potential income

A new report from Attain suggests that Instagram influencers have lost, on average, 33% of their potential income due to the coronavirus pandemic, which equates to £2500 per week.

The study examined 500 influencers on the platform, ranging from micro-influencers to celebrities and found that 65% of them posted less sponsored content during the 8 weeks between 12th March and 7th May compared to the 8 weeks prior.

It also found that influencers with less than 100k followers are being affected the most, with 72% recording a drop in income, and just 16% recording an increase. Meanwhile just over half (55%) those with over 3 million followers saw a fall in earnings, and 30% reported earning more.

Understandably, travel influencers have become the worst off since the outbreak began. Seventy-nine percent are now posting less sponsored content and have had their potential income cut by a huge 47%. Lifestyle influencers came in second, with a 46% average loss of earnings, and fashion influencers have experienced a 31% loss.

TikTok downloads surge in Q1 2020, surpassing 2bn lifetime downloads

Downloads of video sharing app TikTok surged by 315m in Q1 2020, making it the most downloaded app ever in any three-month time period, according to analysis from SensorTower. By comparison, the app saw 187m downloads in Q1 2019, resulting in a roughly 68% increase year-on-year, and a staggering 110m more than its previous record quarter which saw 205m downloads in Q4 2018.

It is now estimated that total downloads of the app have surpassed 2bn since its launch in 2016. So far, India has recorded the most lifetime downloads of any country at 611 million, while China’s version of the app – Douyin – takes second place with 197m and the US takes third with 165m.

While it is common knowledge that media consumption has greatly increased for consumers across the globe as they stay at home, social media engagement has soared. TikTok has evidently become a progressively popular source of entertainment, as well as an outlet for creativity, for consumers at this trying time.

Chart via SensorTower

Between January and March, nearly 60% of misleading Covid-19 Twitter content was not removed

Analysis from Reuters Institute and Oxford University has revealed that 59% of misleading Covid-19 content on Twitter, posted between January and March, was not removed or labelled as such by the company. A sample of 225 posts across three social media sites, labelled as misinformation by fact-checkers during this period, was examined for the study.

Other social media platforms were also unable to flag and remove all false information about the virus but performed much better than Twitter – 27% of YouTube content that was deemed misleading was left on the site during the first quarter, as well as 24% of Facebook’s content.

Most of the misinformation analysed related to actions taken by public authority to fight Covid-19, followed by community spread (e.g. posts claiming certain geographies are to blame for the widespread impact of the virus).

Despite these worrying statistics, platforms appear to be ramping up their response to misleading coronavirus content, with the research recording a 900% increase in fact-checks across the three sites between January and March.

Covid-19 business impact

82% of large enterprises globally have cut hiring budgets

A massive 82% of large enterprises (those with an annual revenue above £50m) have cut hiring budgets, phase three of Econsultancy and Marketing Week’s Business Impact Survey has found. Just 3% of respondents in this category said that they had increased spending as a result of the coronavirus outbreak.

When asked “How has marketing been affected by furloughing/staff reductions compared to other divisions?”, half of large enterprises said that their marketing departments have had the same rates as others. Meanwhile, there were roughly the same number of respondents on either end of the scale (‘lower rates of furloughs/redundancies’ vs ‘higher’), suggesting that overall they have not been disproportionately affected.

However almost a quarter did believe that marketing departments had been ‘significantly’ impacted on an efficiency level due to the reduction of staff, thereby compromising their ability to achieve current goals. A further 42% stated that the ability to achieve current goals was ‘somewhat’ compromised, adding up to a total majority of two-thirds experiencing some impact on productivity.

Just 7% of UK brands are ‘seizing the opportunity’ to invest more in marketing

Our Business Impact Survey also discovered that just 7% of UK brands are investing more in marketing as a strategic approach during the pandemic.

In contrast, 29% of respondents claimed their approach was to ‘stay the course’ by keeping budgets at a steady level and 50% revealed they were cutting marketing budgets in order to ‘live to fight another day’. The remaining 14% appear to still be undecided, saying that it is still too early to know what strategic response to put in place.

When it comes to making these tough decisions, 27% told the survey that their strategy was instinctual. A further 13% said that they base their marketing strategy was based on data, and most (60%) claimed they used a mixture of the two.

Although senior teams across UK organisations appear understanding of the ways investment in marketing could be important during this time, there seems to be a general lack of budget to do so. Indeed, 46% maintained that if they asked to increase media spend, their leadership team would say that, while they understand the motivation, there is no cash to spend. One third also said that finance leaders would ask them to prove their case before an rise in spend was considered.

60% of large global organisations have identified new processes that they might use post-outbreak

Sixty percent of large global organisations (with annual revenues >£50m) have identified new processes that could be used beyond the outbreak, according to the phase three results of Econsultancy and Marketing Week’s Covid-19 Business Impact Survey.

Significant numbers of respondents said they had also observed new ways of working which could be used post-outbreak (82%), innovations in marketing messaging/branding (49%) and innovations in products and services (47%).

The rate at which these observations have grown since the second phase of the survey (conducted on 31st March) is encouraging. Indeed, the percentage of respondents reporting product and service innovations has more than doubled since this date, increasing from 22% to 47% and the proportion reporting innovations in customer communications has risen by 19 percentage points to 43%.

A surge in innovation could be seen as one of the few positive outcomes marketers have experienced since coronavirus spread throughout the world, and it is encouraging to see so many organisations have found new ways of working which improve on their current processes. As a result, it is possible that the coronavirus pandemic could become a primary trigger for major fast-tracked changes in the ways large enterprises operate in the future.

Three-quarters of UK organisations see demand drop for their products and services

Data from Econsultancy and Marketing Week’s phase three Covid-19 Business Impact Survey suggests that as many as 75% of UK organisations are experiencing a drop in demand for their products and services.

This figure, updated on 27th April, is six percentage points higher than equivalent responses from 31st March (phase two) and a huge forty percentage points higher than those from 16th March (phase one). While growth of this trend is clearly slowing, it demonstrates the long-term effects that the outbreak is having on businesses across the country.

Around one third of organisations are now experiencing supply chain issues, with larger organisations (with annual revenues >£50m) most affected. Meanwhile, SMEs are having to make more drastic changes to their hiring plans, budgets and campaigns than their larger competitors.

PR & Communications

Johnson & Johnson receives a 61% uplift in positive mentions from consumers

Johnson & Johnson came out at the top of twenty well-known brands that have received an increase in positive mentions from consumers on Facebook, Twitter, Instagram, YouTube, forums and blogs, analysis from Influential has confirmed.

The brand saw a 61% rise in positive mentions during the four weeks after 31st March, compared with the same period before that date, thought to be due to its recent work aiding the development of Covid-19 vaccines and establishing a relief fund.

Certainly, brands that have taken proactive steps towards the fight against the virus, or to protect their workers jobs, seem to have benefitted most from an increase in positive sentiment, proving just how important brand purpose has become to customers during the crisis. For example, AT&T ranked second in the list, experiencing a 58% increase after it announced that it would continue to pay all of its hourly-wage staff regardless of whether their services were needed.

In addition, Amazon, although controversial in the eyes of some consumers, came third with a 52% uplift after setting up a $25m relief fund in mid-March and hiring more than 100,000 more workers to meet increased demand. Other big names like Target, Walmart, Alibaba and Coca Cola, which also appear high up on the list, have adopted similar approaches focusing on fundraising and manufacturing much-needed equipment.

47% of global consumers expect companies to support hospitals during the Covid-19 crisis

Forty-seven percent of global consumers now expect companies to support hospitals during the Covid-19 crisis, for example by donating funds or using production facilities to create equipment.

This comes as Kantar released the second wave of results from its Global COVID-19 Barometer on 25th March, which details the changing attitudes consumers have had when it comes to brand purpose since the outbreak. Data suggests that the role of companies in wider society has increased, as consumers rely on practical advice, and overwhelmed healthcare centres increasingly rely on donations of money or ‘useful items’.

A further 39%, up by four percentage points since wave one, say that brands should make themselves available to assist regional governments where needed.

Almost a third of consumers claim that they want companies to help them or provide advice, such as keeping fit and healthy at home, or tips on how to relax. Depending on how realistic and helpful brands are at this stage could have implications on how favourably or negatively brands will be remembered once the pandemic has ended.

Interestingly, just 8% of consumers think that brand advertising should be suspended during this time, as a large number believe it to be a distraction amongst the onslaught of daily news coverage.

Consumers care about coronavirus responses, but here’s how companies can avoid overdoing it

Entertainment

22% of UK public now ‘often’ or ‘always’ actively avoid the news

Twenty-two percent of the UK public now ‘often’ or ‘always’ actively avoid the news, a rise of 7 percentage points since mid-April, a study from Reuters Institute and Oxford University has found. Of those that do, 66% gave the reason that it had a bad effect on their mood, 33% said that there is too much news covering the topic, and a further 28% said that there is ‘nothing they can do with the information’.

While initial consumption towards the beginning of the coronavirus crisis in the country saw a sharp spike, more and more consumers are choosing to avoid news programmes, publications and apps as the outbreak continues. This is particularly the case for female respondents, of whom 26% steer clear of updates compared to 18% of male respondents.

When it comes to the type of media people are likely to evade, most stated they avoid watching news on TV (78%), followed by websites and apps (55%) and social media (49%). This growing trend could have a substantial impact on the overall traffic on popular news websites, as well as the number of app downloads and reattributions in this sector.

Half a billion Chinese consumers now livestream content

Official figures have revealed that over half a billion Chinese consumers are live-streaming content as of March this year, a rise of 163 million users since the end of 2018. The numbers are thought to have been intensified by the lockdown imposed on the region earlier this year and represent 62% of all internet users in China.

WeChat, Douyin and RED, some of China’s most popular apps and social platforms, all launched live-streaming capability during the peak of their coronavirus epidemic, and as such this type of media consumption has secured a key role in the ecommerce industry in the country.

Ecommerce now accounts for nearly 30% of all content live-streamed, outperforming sports broadcasting and live concerts at 23.5% and 16.6% respectively. Meanwhile, viewership of live gaming grew by 22 million over the last 18 months to 260 million and live host shows grew by 43.7 million to 207 million.

Netflix gains almost 16 million new subscribers in Q1 2020

Netflix has gained 15.8m new subscribers during Q1 2020, more than double its original 7m target for the period, according to the Financial Times. Almost 7m of these subscriptions originated from the EMEA region, while 3.6m came from Asia.

As a result, revenues have risen by 28% in the first quarter compared to the same time in 2019, reaching $5.77bn which is slightly higher than the forecasted $5.4bn expected by the company. Meanwhile, Netflix’s stock has surged by around 30% so far this year.

However, concerns are growing about how permanent this subscriber growth will be, and the brand has warned its shareholders that it anticipates both viewership and membership to decline once the coronavirus outbreak slows in its biggest markets.

A delay in spending caused by the inability to film its latest series and films is also thought to have skewed Netflix’s first quarter financials, with the results displaying a $162m positive cash flow. It now expects to spend $1bn over the course of the rest of 2020, significantly lower than its initial estimated spend of $2.5bn.

Employment & recruitment

Recruitment for London’s tech industry falls by 57%

Recruitment for permanent roles in London’s technology industry has fallen by 57% since the outbreak reached the UK. This is according to research from talent.io (as reported by technology publication Verdict), which analysed more than 5,000 London tech start-ups using its platform and others like LinkedIn and Indeed.

Before the coronavirus pandemic sent London, and the rest of the UK, into lockdown, the technology industry in the capital was home to more tech start-ups worth over $1bn than any other location in Europe. Since then, companies in this and other sectors have seen budgets for new hires cut drastically due to slowing revenue and increasing economic uncertainty.

This is a trend occurring all around the world, as reflected by a recent study carried out by Verdict that revealed that, on average, 35% of similar companies from the US, UK, Canada and India have temporarily paused recruitment within the last few months.

92% of US & UK marketers rate their organisations as being ‘pretty well’ or ‘very well’ equipped for remote working

The marketing, advertising and PR industries in the US and UK are the ‘most ready’ for remote working, suggests results from the seventh phase of GlobalWebIndex’s coronavirus research.

Ninety-two percent of workers in the marketing/advertising/PR industries agreed that their organisations are ‘pretty well’ or ‘very well’ equipped to operate with a fully remote workforce, while organisations in the IT/tech/software (76%) and financial services (69%) industries ranked second and third respectively. Senior staff and those in management roles are more likely to believe their company is well equipped for remote working than junior staff.

On the contrary, sectors which rely on the presence of staff in physical settings such as retail and healthcare scored worst on their readiness.

It also appears that larger organisations are less prepared for remote working than smaller ones. Companies that employ between 250-2000 workers are most ready according to their employees (67%), but those with over 2000 workers are the least equipped (29%). This is likely due to bigger companies being more reliant on established processes and organisational structures, thus making them less agile than their smaller counterparts.

Young people in the UK most worried about impact of coronavirus on jobs and wages

A new study by YouGov has revealed that people aged 18 to 24 are more worried than any other age group about the impact coronavirus will have on the job market in the long-term. According to figures published on 24th March, in a survey of 1,619 adults in the UK, seven in ten 18 to 24-year-olds say they worry that the coronavirus will cause higher unemployment for a long time. This figure drops for every other subsequent age group.

The survey also found that 54% of 18 to 24 year olds believe that coronavirus will affect wages in the long-term, compared with 43% aged 50 and over.

As the pandemic continues to spread, anxiety levels about the economy are rising. The number of people worried that coronavirus will cause long-term unemployment jumped from 26% to 62% in just the space of a week. Similarly, two thirds of Brits now believe there will be lasting damage to the economy, which is up from 36% a week before.

The post Stats roundup: coronavirus impact on marketing, ecommerce & advertising appeared first on Econsultancy.

Be First to Comment